HEIF allocations are a good guide to understanding how well your university may perform under the new Knowledge Exchange Framework.

In this latest blog post from university research commercialisation specialists ProspectIP, we share insights into HEIF allocations over the past four years and provide advice on how to boost your income from knowledge exchange work.

New university clusters for assessing knowledge exchange performance

Research England has proposed the clustering of universities into clusters E, J, M, V and X, plus Arts specialists, Social Science and Business specialists, and STEM specialists.

These cluster groups will be used to assess an individual university’s performance relative to the average of its peers within its cluster, against a range of seven ‘perspectives’:

- Partnerships with the public and third sector

- Partnerships with business

- IP & Commercialisation

- Skills, Enterprise and Entrepreneurship

- Local growth and regeneration

- Community and public engagement

- Collaborative research

In this article, we focus on Cluster E universities, which share the following characteristics:

- Large universities with broad discipline portfolio across both STEM and non-STEM generating a mid-level amount of world leading research across all disciplines.

- Significant amount of research funded by government bodies, NHS and other public bodies; 9.5% from industry.

- Large proportion of part-time undergraduate students, and small postgraduate population dominated by taught postgraduates.

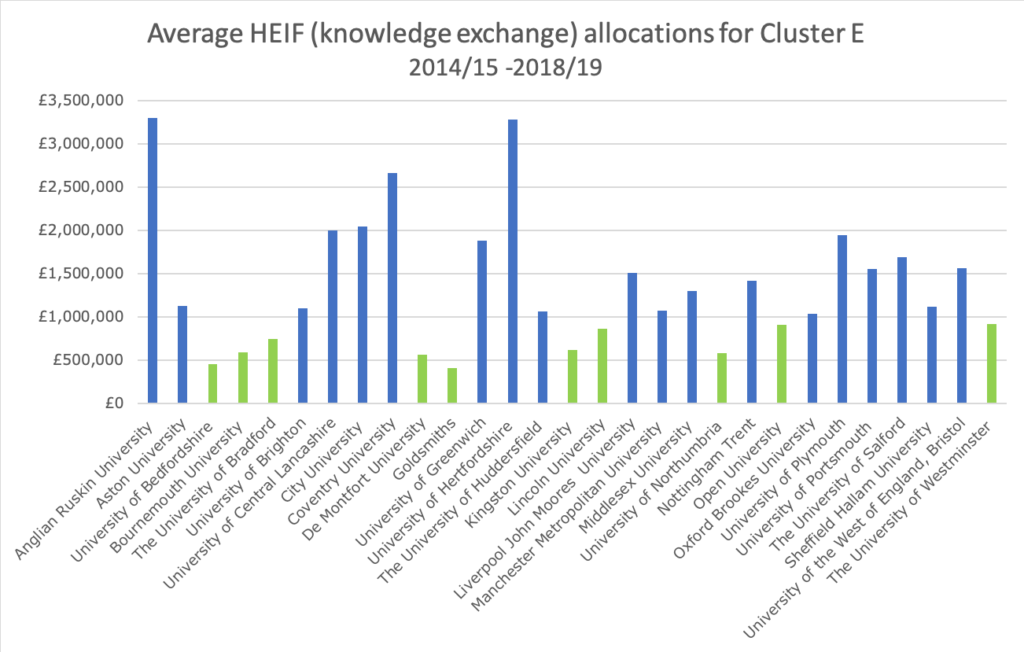

The team at ProspectIP has calculated the average HEIF allocations between 2014/15 and 2018/19 for all universities in Cluster E, as shown in the diagram below.

Incomes range from £0.4m to £3.3m. Universities with a HEIF allocation of less than £1m are highlighted in green.

How to prepare for the Knowledge Exchange Framework

However your university has performed, you will want to ensure you are ready for the Knowledge Exchange Framework (KEF) when it is rolled out in 2019/2020.

KEF will provide information on how universities and other higher education institutions share knowledge, expertise and other assets for economic and societal benefit. Knowledge exchange can include everything from outreach, student volunteering, staff development, external training, and public engagement, through to start-ups and spin-outs.

Performance will be assessed within each of the newly-formed clusters. (We have put a guide to the clusters at the end of this blog.)

As part of the assessment, universities will need to be able to effectively capture, record and analyse all their diverse knowledge exchange activities – and translate them into benefits and impact.

ProspectIP can help you understand what the top quartile of universities are doing to boost their income from Knowledge Exchange work.

We can provide insights into why the leading HEIs in your cluster excel in Knowledge Exchange, looking at their approach, practices and processes, and show you how to adopt and implement best practice in Knowledge Exchange.

We understand the university research landscape and have a strong track record in working with university innovation teams to help them to commercialise their research and identify the impact and societal benefit of their output, across both STEM and non-STEM subjects.

For many of our university clients we act as an extension of their in-house innovation or enterprise teams to provide a cost-effective IP and research management solution, sharing resource and expertise as required. We also work on a project basis where an organisation or university needs specific support or has a gap in its expertise.

For help or advice on getting your university ‘KEF-ready’, please contact ProspectIP for a confidential conversation.

A guide to the Clusters for KEF

| Cluster E | Large universities with broad discipline portfolio across both STEM and non-STEM generating a mid-level amount of world leading research across all disciplines

Significant amount of research funded by government bodies / hospitals; 9.5% from industry Large proportion of part-time undergraduate students, and small postgraduate population dominated by taught postgraduates. |

| Cluster J | Mid-sized universities with limited funded research activity and generating limited world-leading research

Academic activity across STEM and non-STEM including other health, computer sciences, architecture/planning, social sciences and business, humanities, arts and design Research activity funded largely by government bodies / hospitals; 13.7% from industry |

| Cluster M | Small universities with limited funded research activity and generating limited world-leading research

Academic activity across disciplines, particularly in other health domains and non-STEM Much of research activity funded by government bodies / hospitals; 14.7% from industry |

| Cluster V | Very large, very high research intensive and broad-discipline universities undertaking significant amounts of world-leading research

Research funded by range of sources incl. RCs, gov’t bodies, charities and 10.2% from industry Discipline portfolio: significant activity in clinical medicine and STEM Student body includes significant numbers of taught and research postgraduates. |

| Cluster X | Large, high research intensive and broad-discipline universities undertaking a significant amount of world-leading research

Much of research funded by RCs and government bodies; 8.5% from industry Discipline portfolio balanced across STEM and non-STEM with little or no clinical medicine activity Large proportion of taught postgraduates in student population |